Norton Motorcycles cannot be rescued as a “going concern” because it owes its creditors a whopping £28,352,089 (more than $A57m).

However, administrators are still negotiating with eight potential buyers.

A Joint Administrators’ Proposals report to creditors sent to us by administrators BDO UK says Norton Motorcycles cannot be rescued in its current form.

“Due to the extent of the Company’s known liabilities (including sums owed to Holdings), it is not considered that the Company will be rescued as a going concern,” the report proposes.

In January, Norton Motorcycles went into administration amid claims of pension fund frauds and a £300,000 unpair tax bill.

Almost half the debt is in the 228 pension funds that owes £14m.

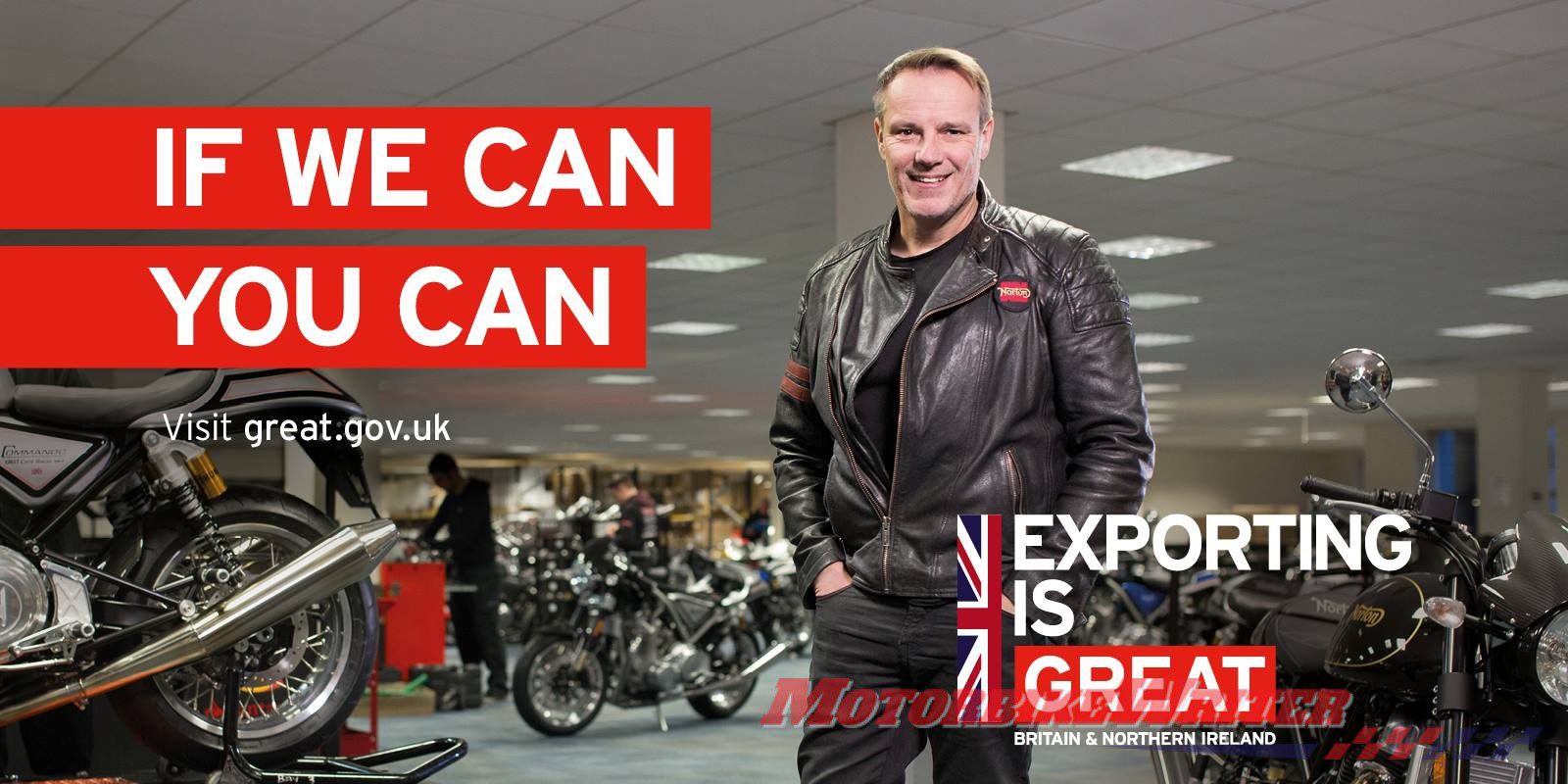

UK Pensions regulator is now investigating boss Stuart Garner (pictured above in a UK government export campaign) over his role in the pension scheme to fraudulently fund his company.

The remainder of the debts are to secured creditor Metro Bank (£7m) and the rest to unsecured creditors.

BDO UK’s report to creditors will soon be filed at Companies House and made public.

If anyone is owed money and wants the report, I will email it to them. Contact me via email here.

Buyers sought for Norton Motorcycles

BDO UK is also still considering selling the company, claiming it has received “significant interest” from potential buyers:

A deadline for initial offers was set for 21 February 2020, which resulted in 29 formal offers being received for all of the business and assets of the Company. Following the Joint Administrators’ assessment of the offers received, eight offers were progressed to phase two of the sales process, where additional information was being provided to such parties together with site visits and meetings with management, if requested. A deadline for best and final offers has been set for close of business on 25 March 2020, with a view to concluding a transaction as soon as possible thereafter. Further details of the indicative offers received cannot be provided at this stage, as to do so may prejudice the ongoing sales process. Accordingly, a further update will be provided in the Joint Administrators’ next report to creditors.

So, while we don’t know the identity of the buyers yet, the rumour mill suggests Japanese and Chinese motorcycle companies, John Bloor of Triumph Motorcycles and even motorcycle fan Keanu Reeves whose first bike was a Norton.

SuperBike Magazine also claims the company’s biggest single investor, Steve Murray, could be interested in buying the company.

They say he invested his entire life savings or about £1 million for 10% equity and loaned the company an extra £500,000.

He was a company director for three months, but chose to be “hands-off”.

Operations mothballed

BDO UK has mothballed Norton’s trading operations and production, but continues to pay employees while it tries to find a buyer:

It was not considered possible to continue production activity whilst in administration due to (i) the increased level of costs that were anticipated to be incurred in continuing production, (ii) difficulties in sourcing raw materials without appropriate lines of credit, which would exacerbate the cash position whilst in administration and (iii) it not being possible to provide warranties to any customer who may acquire a motorcycle from the Company whilst in administration. This strategy has therefore been adopted to provide the best opportunity to source a purchaser for the Company’s business and assets, whilst seeking to minimise the associated holding costs.

The third and final proposal by the administrators is to sell off assets to pay creditors if it cannot find a buyer.

However, assets appear only to amount to enough to pay Metro Bank which is owed £7m.

At least in Australia, importers Brisbane Motorcycles have returned deposits to those who paid for bikes not yet delivered.