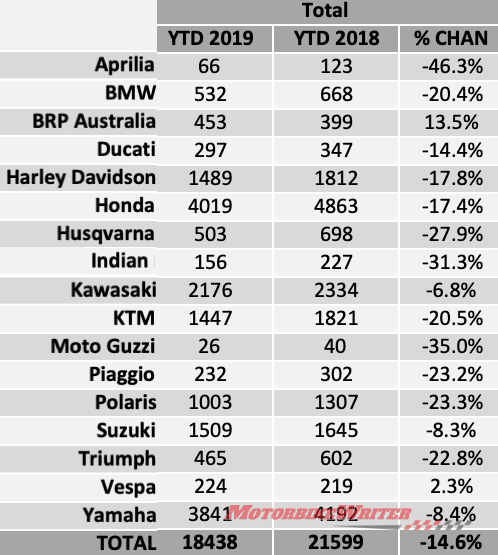

Motorcycle sales are continuing their slide and even picking up pace with a 14.6% drop in the first quarter of 2019.

It’s the biggest quarterly drop since the slide began in 2017 and cause for concern.

According to data released today by the Federal Chamber of Automotive Industries (FCAI), 18,438 motorcycles, ATVs and scooters were sold during the first three months of 2019.

That compares with 21,599 for the same period in 2018 when sales were down 13.4% on the previous year. Sales results for the full year of 2018 were down 8.7% and are down almost 30% since the end of 2016.

Some of the sales decline could be due to the uncertainty in the economy owing to the impending Federal Election.

FCAI motorcycle spokesman Rhys Griffiths agrees, but adds that lending practices and high house prices also have an effect.

“We’d all like to think there would be a bump in sales after election, but if there is a change of government, people would also be less likely and take a wait-and-see approach,” he says.

“If there is a bounce, it may be in the third quarter with the seasonal implications of spring as well.”

All categories were affected by the tumbling pace of sales except scooters which were up 29.6% from a low base eroded over the past few years.

Rhys says the scooter sales bump could be due to delivery services such as Uber Eats.

Pace leaders and losers

Honda was the overall leader with a 21.8% share of the national market, but a 17.4% drop in sales.

Yamaha was second with a 20.8% share (down 8.4% in sales) and Kawasaki with 11.8% (-6.8%).

Road motorcycles fell 19.2% as Harley-Davidson returned to the lead again with a 19.1% share even though Harley sales continued to plummet 17.8%.

Yamaha was second with 18.2% (down 8% in sales) and Honda with a share of 16.6%, but down a whopping 37.9%.

We suspect this is due to Australia Post not buying postie bikes which for the first time in decades are not in the top 10 bikes.

ROAD BIKES |

||||

| January – March 2019 compared with 2018 | ||||

| Manufacturer | Model | Total | ||

| YTD 2019 | YTD 2018 | % CHAN | ||

| Honda | CB125E | 318 | 432 | -26.4% |

| Yamaha | MT07L | 281 | 233 | 20.6% |

| Kawasaki | NINJA 400 | 250 | 139 | 79.9% |

| Yamaha | MT-09 | 189 | 210 | -10.0% |

| Yamaha | YZF-R3A | 189 | 286 | -33.9% |

| Harley-Davidson | FXBRS | 185 | 208 | -11.1% |

| Yamaha | MT03LA | 180 | 202 | -10.9% |

| Honda | CMX500 | 171 | 192 | -10.9% |

| Harley-Davidson | FLFBS | 161 | 107 | 50.5% |

| Honda | GROM | 160 | 193 | -17.1% |

The ATV/SSV category showed a decline of 23.7%.Polaris maintained leadership with a 31.2% share, followed by Honda (19.5%) and Yamaha (18.4%).

Off-road sales fell 9.3%. Yamaha maintained its lead with a 27.8% share over Honda (26.4%) and KTM (18.1%).

Top 10 sales by category

Adventure Touring |

||||

| January – March 2019 compared with 2018 | ||||

| Manufacturer | Model | Total | ||

| YTD 2019 | YTD 2018 | % CHAN | ||

| Suzuki | DR650SE | 121 | 139 | -12.9% |

| BMW | R 1250 GS Adventure | 97 | 0 | 100% |

| BMW | R 1250 GS | 85 | 0 | 100% |

| Honda | CRF1000 | 81 | 100 | -19.0% |

| Kawasaki | KLR650 | 70 | 79 | -11.4% |

| Suzuki | DL650 | 65 | 60 | 8.3% |

| Suzuki | DL1000 | 44 | 25 | 76.0% |

| BMW | G 310 GS | 44 | 66 | -33.3% |

| KTM | 1090ADVR | 37 | 54 | -31.5% |

| Husqvarna | 701END | 37 | 50 | -26.0% |

Cruiser |

||||

| January – March 2019 compared with 2018 | ||||

| Manufacturer | Model | Total | ||

| YTD 2019 | YTD 2018 | % CHAN | ||

| Harley Davidson | FXBRS | 185 | 208 | -11.1% |

| Honda | CMX500 | 171 | 192 | -10.9% |

| Harley Davidson | FLFBS | 161 | 107 | 50.5% |

| Kawasaki | Vulcan S | 147 | 168 | -12.5% |

| Yamaha | XVS650/A | 140 | 94 | 48.9% |

| Indian Motorcycle | Scout | 96 | 147 | -34.7% |

| Harley Davidson | FLSB | 95 | 68 | 39.7% |

| Harley Davidson | FXFBS | 54 | 63 | -14.3% |

| Harley Davidson | XL883N | 53 | 70 | -24.3% |

| Harley Davidson | FXBB | 52 | 84 | -38.1% |

Naked |

||||

| January – March 2019 compared with 2018 | ||||

| Manufacturer | Model | Total | ||

| YTD 2019 | YTD 2018 | % CHAN | ||

| Honda | CB125E | 318 | 432 | -26.4% |

| Yamaha | MT07L | 281 | 233 | 20.6% |

| Yamaha | MT-09 | 189 | 210 | -10.0% |

| Yamaha | MT03LA | 180 | 202 | -10.9% |

| Honda | GROM | 160 | 193 | -17.1% |

| Yamaha | XSR700LA | 99 | 77 | 28.6% |

| Kawasaki | Z900RS | 92 | 126 | -27.0% |

| KTM | 390DUKE | 78 | 71 | 9.9% |

| Honda | Monkey | 62 | 0 | 100% |

| Yamaha | MT10 | 58 | 74 | -21.6% |

Sport Touring |

||||

| January – March 2019 compared with 2018 | ||||

| Manufacturer | Model | Total | ||

| YTD 2019 | YTD 2018 | % CHAN | ||

| Yamaha | YZF-R3A | 189 | 286 | -33.9% |

| Kawasaki | Ninja 650L | 95 | 86 | 10.5% |

| Yamaha | MT09TRA | 57 | 31 | 83.9% |

| Honda | CBR650FL | 43 | 69 | -37.7% |

| Kawasaki | VERSYS-X 300 | 41 | 42 | -2.4% |

| Suzuki | GSX-S125 | 40 | 18 | 122.2% |

| Kawasaki | Ninja 1000 | 35 | 43 | -18.6% |

| Suzuki | GSX-R125 | 34 | 15 | 126.7% |

| Yamaha | MT07TRL | 33 | 18 | 83.3% |

| Suzuki | GSX250R | 26 | 40 | -35.0% |

Super Sport |

||||

| January – March 2019 compared with 2018 | ||||

| Manufacturer | Model | Total | ||

| YTD 2019 | YTD 2018 | % CHAN | ||

| Kawasaki | NINJA 400 | 250 | 139 | 79.9% |

| Honda | CBR500R | 82 | 186 | -55.9% |

| Honda | CBR1000RR | 67 | 35 | 91.4% |

| Ducati | Superbike | 58 | 0 | 100% |

| Honda | CBR600RR | 45 | 24 | 87.5% |

| KTM | RC390 | 39 | 58 | -32.8% |

| Yamaha | YZF-R1 | 37 | 32 | 15.6% |

| Kawasaki | Z400 | 36 | 0 | 100% |

| Suzuki | GSX-R750 | 35 | 17 | 105.9% |

| Kawasaki | Ninja ZX-6R | 32 | 11 | 190.9% |

Touring |

||||

| January – March 2019 compared with 2018 | ||||

| Manufacturer | Model | Total | ||

| YTD 2019 | YTD 2018 | % CHAN | ||

| Harley Davidson | FLHXS | 112 | 54 | 107.4% |

| Harley Davidson | FLHTK | 66 | 34 | 94.1% |

| Harley Davidson | FLTRXS | 47 | 21 | 123.8% |

| Harley Davidson | FLHTCUTG | 43 | 36 | 19.4% |

| Harley Davidson | FLHRXS | 41 | 37 | 10.8% |

| Harley Davidson | FLHX | 30 | 33 | -9.1% |

| Harley Davidson | FLHXSE | 29 | 23 | 26.1% |

| BMW | R 1250 RT | 29 | 0 | 100% |

| Indian Motorcycle | Chieftain | 19 | 12 | 58.3% |

| Harley Davidson | FLTRX | 18 | 5 | 260.0% |

LAMS Approved |

||||

| January – March 2019 compared with 2018 | ||||

| Manufacturer | Model | Total | ||

| YTD 2019 | YTD 2018 | % CHAN | ||

| Yamaha | WR450F | 332 | 183 | 81.4% |

| Honda | CB125E | 318 | 432 | -26.4% |

| Yamaha | MT07L | 281 | 233 | 20.6% |

| Honda | NSC110 | 270 | 105 | 157.1% |

| Kawasaki | NINJA 400 | 250 | 139 | 79.9% |

| Yamaha | YZF-R3A | 189 | 286 | -33.9% |

| Yamaha | MT03LA | 180 | 202 | -10.9% |

| Suzuki | ADDRESS | 177 | 48 | 268.8% |

| Honda | CMX500 | 171 | 192 | -10.9% |

| Honda | GROM | 160 | 193 | -17.1% |

Scooters |

||||

| January – March 2019 compared with 2018 | ||||

| Manufacturer | Model | Total | ||

| YTD 2019 | YTD 2018 | % CHAN | ||

| Honda | NSC110 | 270 | 105 | 157.1% |

| Suzuki | ADDRESS | 177 | 48 | 268.8% |

| Vespa | GTS 300 | 111 | 86 | 29.1% |

| Piaggio | Fly 150 | 89 | 120 | -25.8% |

| Honda | MW110 | 72 | 45 | 60.0% |

| Honda | WW150 | 69 | 70 | -1.4% |

| Yamaha | XMAX300 | 69 | 40 | 72.5% |

| Vespa | PRIMAVERA 150 | 61 | 60 | 1.7% |

| Honda | C125A | 47 | 0 | 100% |

| Piaggio | ZIP 50 | 45 | 73 | -38.4% |

FCAI members

The FCAI members represent 90% of all motorcycle sales in Australia.

There are 22 minor manufacturers not included in the official FCAI figures.

They are mainly small-volume importers Norton, Hyosung, VMoto, Benelli, Bimota, Bollini, CFMoto, Confederate, Daelim, EBR, Kymco, Laro, Megelli, Mercury, MV Agusta, PGO, Royal Enfield, SWM, SYM, TGB, Ural and Viper.