Australia isn’t alone in the motorcycle sales slump with global sales down 5.4% in the first quarter of 2019, mainly due to slumps in the largest motorcycle markets, India and China.

Federal Chamber of Automotive Industries (FCAI) motorcycle spokesman Rhys Griffiths says the contraction of Chinese and Indian markets is one of the biggest threats to the future of motorcycling.

Rhys says the “gradual gentrification of Chinese society means the aspirational purchase is no longer a motorcycle, but a car”.

“This represents a gradual move away from motorcycles as a mode of transport,” he says.

“Maybe the Indians will follow as they become more prosperous,” he says.

Last year India surpassed China was the biggest motorcycle market in the world with more than 20 million motorcycle sales, up 2.6m from the previous year and almost double the sales of just seven years ago.

However, in a worrying trend, sales in India started to slow late last year and have continued to slump this year.

If the global sales slide continues, motorcycle companies will see less profit and therefore less money will be spent on research and development of new models.

Good news

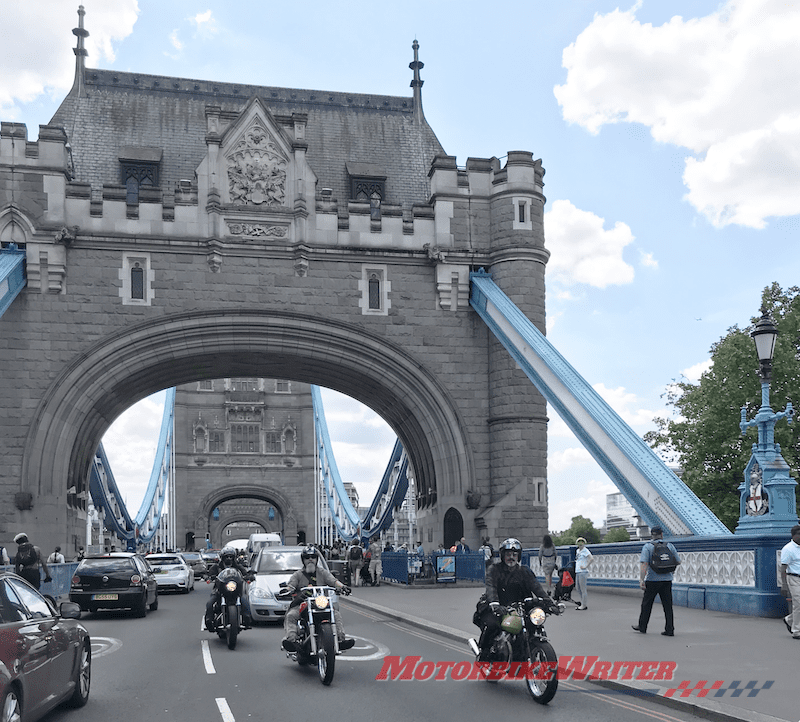

There seems to be some good news on the horizon with the European market booming by 23%.

But most of that increase is in e-bikes or pedal-assisted electric bicycles which are counted in the motorcycle numbers, unlike Australia where they are not included.

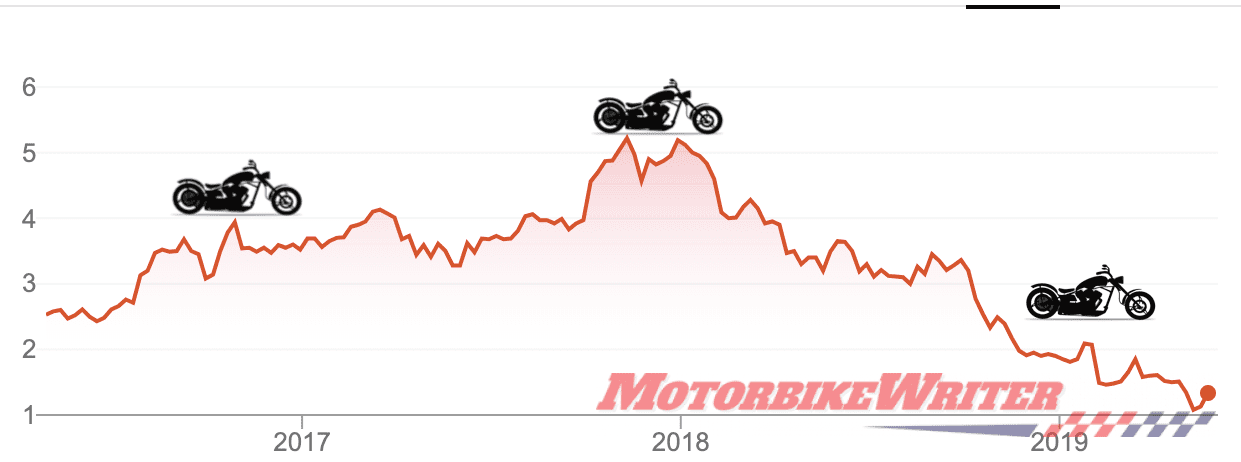

Since then, sales have picked up their downhill pace with a 14.6% decline in the first quarter of 2019, the biggest quarterly drop since the slide began in 2017 and cause for concern.

An indication of the Aussie slide is the share price for MotorCycle Holdings which is the parent company of TeamMoto dealerships.

Since it went public in 2016 at about $2.50, shares reached a peak of $5.22 at the end of 2017 but plummeted to a record low of $1.08 in early May. They were $1.35 at the close of the ASX on Friday.

Global sales

ASIA: Motorcycle sales down 8.8 million (-9.9%)

ASEAN: Sales are up 5.9% to 34 million, led by Indonesia with 15% growth, while the big markets of Vietnam and Thailand are dropping.

LATIN AMERICA: Sales marginally down despite 15% growth in Brazil and 15.9% in Colombia. These were offset by heavy losses in Mexico, Argentina and Ecuador.

NORTH AMERICA: USA was down 3% and Canada down 5.2% in 2018 and the trend appears to be continuing in Q1 2019.

EUROPE: Up 23.6% in 27 of 28 countries in the first quarter. Greece was down 2.2%. The fastest sales growth was in Poland (87.3%), followed by Romania (86.9%), Hungary (72%), Lithuania (71%) and Slovakia (+54%). The top five were France (31.8%), Italy (17%), Spain (19.1%), Germany (22.1%) and the UK 10%.